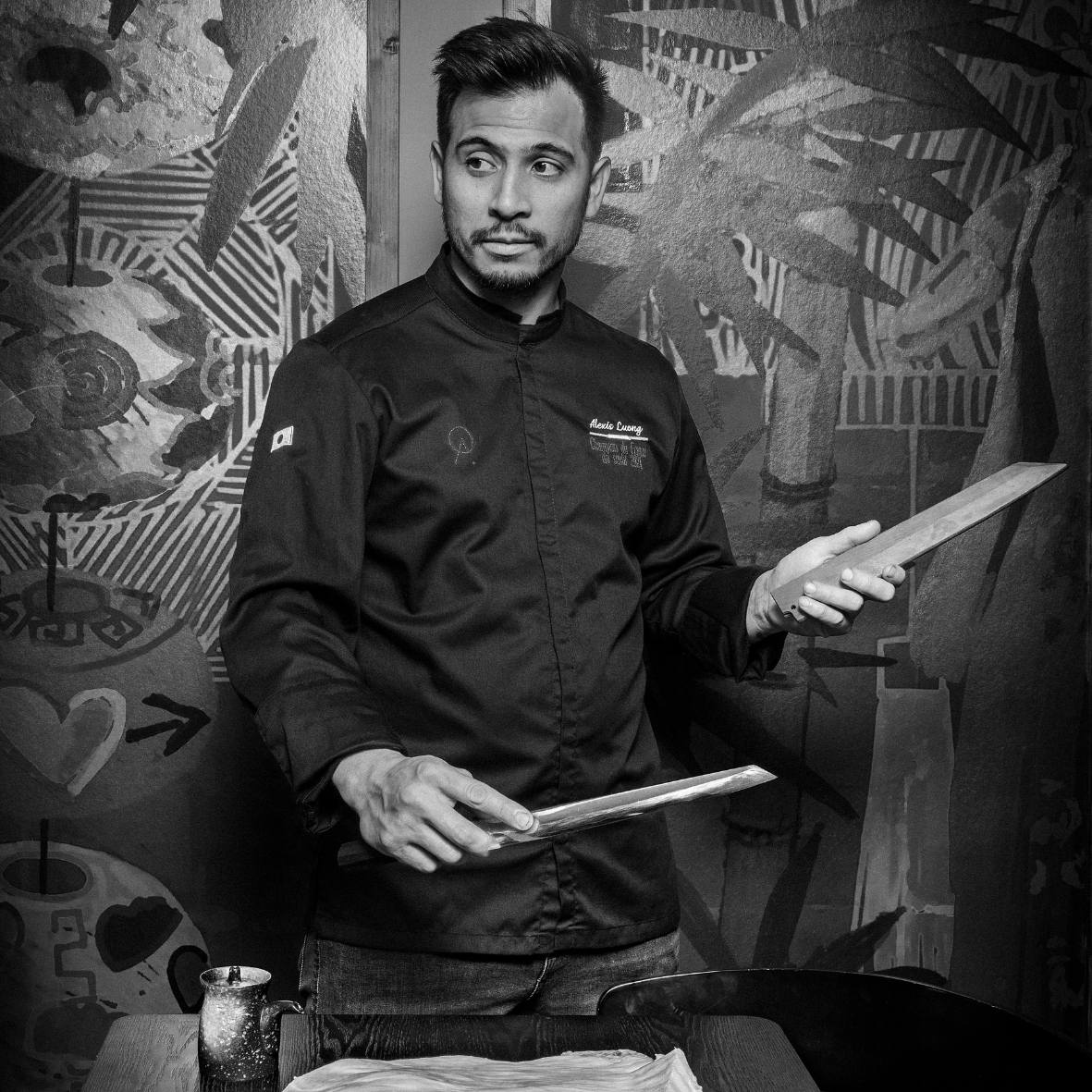

Ingrid Brodin

Investing in winemaking know-how

© Ed Wright - EDV images

Une application mobile pour investir dans le vin en toute simplicité, en fonction de son budget.

Innovation Award

Some swear by property investments. Some diversify their portfolio by turning their attention to works of art or luxury goods such as cars, watches, bags, beverages, and even trainers. “I adore wine, it’s something very close to my heart. Investing in fine wine is nothing new, and it brings exciting opportunities to more and more people”, says Ingrid Brodin, who left Sweden at the age of 15 to study at Oxford in England then at Milan’s Bocconi University. After training in marketing, management and finance, she began working in the textile industry and film production before launching a start-up in Monaco with a friend, Victoria Palatnik. Vindome is an online investment platform. The idea is to choose a wine, purchase it, outsource its storage to make sure it is kept at the right temperature and humidity, then sell it on when the time is right. “There is a lot of competition in this niche, but our A to Z service is unique. One of the first obstacles you come across when you embark on this type of acquisition is authenticity. You need to make sure your bottle is genuine. We don’t work with traders on the secondary market, only directly with producers.” The business was first launched in Italy and Europe, and the pair are now expanding to the Middle East and Asia.

Vindome

For savvy amateurs

“There are some great wines coming out of the Côte d’Azur but they’re not investment wines.

A high percentage of the bottles we offer are made in Bordeaux, and but we do have a good number from Piedmont, Tuscany, America, Argentina and even Germany”, continues Ingrid Brodin. For this type of asset, investors are obviously focused on the long term: “You can buy wines and sell them on after 2 to 5 years, or 5 to 10, or even after 10 years. Bottling procedures are much better than they used to be, so it’s rare that we have to change the corks, and you can now keep the top grand cru wines for up to 80 years. The purchase price is essential and that’s why buying en primeur wine in barrels before they are bottled is a great investment because the price is usually lower.” While some knowledge of wine is helpful in making this type of investment, the platform can be tailored to suit the level of risk customers want to take, depending on their profile. It’s not all about Bitcoin! Young people are investing in wine because they are receptive to know-how related to the fruits of the earth, though the platform does not yet offer organic wines.

Just like any start-up, it all began with R&D and fundraising. Vindome’s technical development team, which is based in Bulgaria, took more than a year to develop the service, and the management and marketing aspects are handled in Monaco. The platform that was co-founded by Ingrid Brodin offers several investment options: you can buy directly on the live market or through specific collections which are a selection of wines based on a theme. They might all be wines from South America or Tuscany, or from wineries run by women. Vindome also provides a wine storage and monthly insurance service for buyers.

Création : 2019

Localisation : Monaco

Activité : Finance

Directrice : Ingrid Brodin

Effectifs : 15 employés

Côteweb 2021, création de site Internet sur Nice

Côteweb 2021, création de site Internet sur Nice